Self-employed? Gig platform worker? Landlord? Sole trader? High-earner?

Join the "untied" tax revolution.

✔ HMRC-recognised

✔ Designed to be the best software for Making Tax Digital (MTD)

✔ Designed around you

✔ Outstanding customer support

✔ Trusted and secure

✔ Mobile app and in-browser

✔ Built-in "untied" AI ✨

✔ Award-winning

Already using "untied"? Sign in

Fitness instructor

Stress free! With "untied" I'm confident I'll be able to stay on top of MTD

Nail salon owner

I am honestly so impressed with this app. I am such a technophobe, but it's so easy to use. I'm completely up to date with allocating things on it. I've never been so organised!

Freelance content creator

Definitely worth it. Saves me a lot of time and money. So glad I discovered this app.

We designed "untied" to be the best for MTD - securely connect bank accounts, credit cards and tax accounts. Upload or add data manually. Request payments and send invoices, so you can stay in control of what you’re owed.

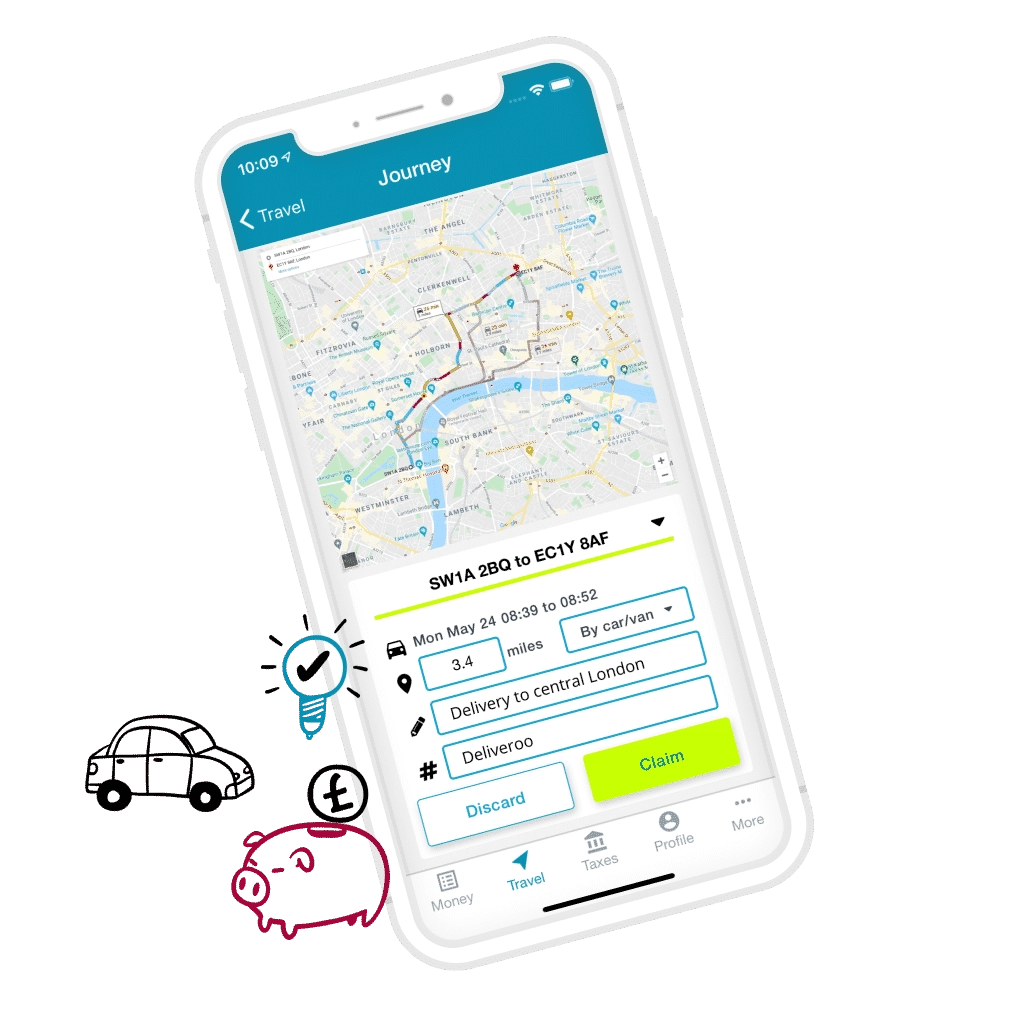

See real-time MTD updates and insights on your tax position. Track your mileage automatically - however you travel.

"untied" claims reliefs you’re entitled to and helps you follow the rules to save tax wisely.

With "untied" you can follow the rules and submit your data in a way that makes sense to you. No complicated forms. No fiddly calculations. MTD for Income Tax.

You can even use "untied" to pay HMRC.

"untied" sends all the right information to HMRC to register you as self-employed, so you can spend more time on you and your business.

"untied" is recognised by HMRC and secured with bank-level encryption. Prices include VAT.

Although you can subscribe through the app stores, the most flexible plans are available from this website.

Free 30 day trial with any plan (paid plan required for filing).

"untied Lite"

Good for those starting out as gig workers, delivery riders and drivers

Works in browser (desktop and mobile)

Mobile app

Manual transaction input

Link unlimited bank accounts

Set rules

Manual journey logging

Single salaried employment - PAYE income (SA102)

Self-employment income up to £90k (SA103s)

File and pay directly to HMRC

Share access with your accountant or adviser

Making Tax Digital (MTD)

Automatic optimisation where allowed

Property income up to £90k (SA105)

Supports capital gains (SA108) including crypto

Supports non-residence (SA109)

Supports company director (SA102)

Request payments

Import/export CSV

No credit card required

"untied Pro" including MTD

Best for most users

Complete software that also supports MTD. Best option for most users if you want to streamline your tax return and save the most time

Works in browser (desktop and mobile)

Mobile app - iOS and Android

Automatic, import and manual transactions

Link unlimited bank accounts

Set rules

Automatic and manual journey logging

Multiple salaried employment - PAYE income (SA102)

Self-employment unlimited if you're in MTD

File and pay directly to HMRC

Share access with your accountant or adviser

Making Tax Digital (MTD)

Automatic optimisation where allowed

Property unlimited if you're in MTD

Supports capital gains (SA108) including crypto

Supports non-residence (SA109)

Supports company director (SA102)

Request payments

Import/export CSV

No credit card required

Notes: "untied Pro" supported income streams: Self-employment income < £90k; Property income < £90k (unless in MTD and not VAT registered in which case limits don't apply); PAYE salary income; Dividend income; Bank interest; Capital gains. It works on the cash basis, and with accounting periods 6 April - 5 April. While we support SA109 for residence and the remittance basis, untied only allows you to enter certain foreign income sources and does not include SA106 - see more by typing "SA106" in the "Ask us" tool in the bottom right. Advanced or more complex parts of certain forms may not be supported - check during the trial that your needs are covered. For all plans there may be further flexible add-ons for advanced services such as onboarding with HMRC and "untied Express Submit".

Trial mode supports test tax return filing only. For full and final tax return submissions a paid plan is required. Adviser access is subject to adviser onboarding at our discretion, and restricted to supporting fully paid year-round "untied Pro" users.

"untied" is designed to be used on an ongoing basis. Shorter subscriptions help you spread the cost, not to be used once a year - however attractive that may seem.

X