Remember to submit any outstanding tax returns by 28 February to avoid a late filing penalty

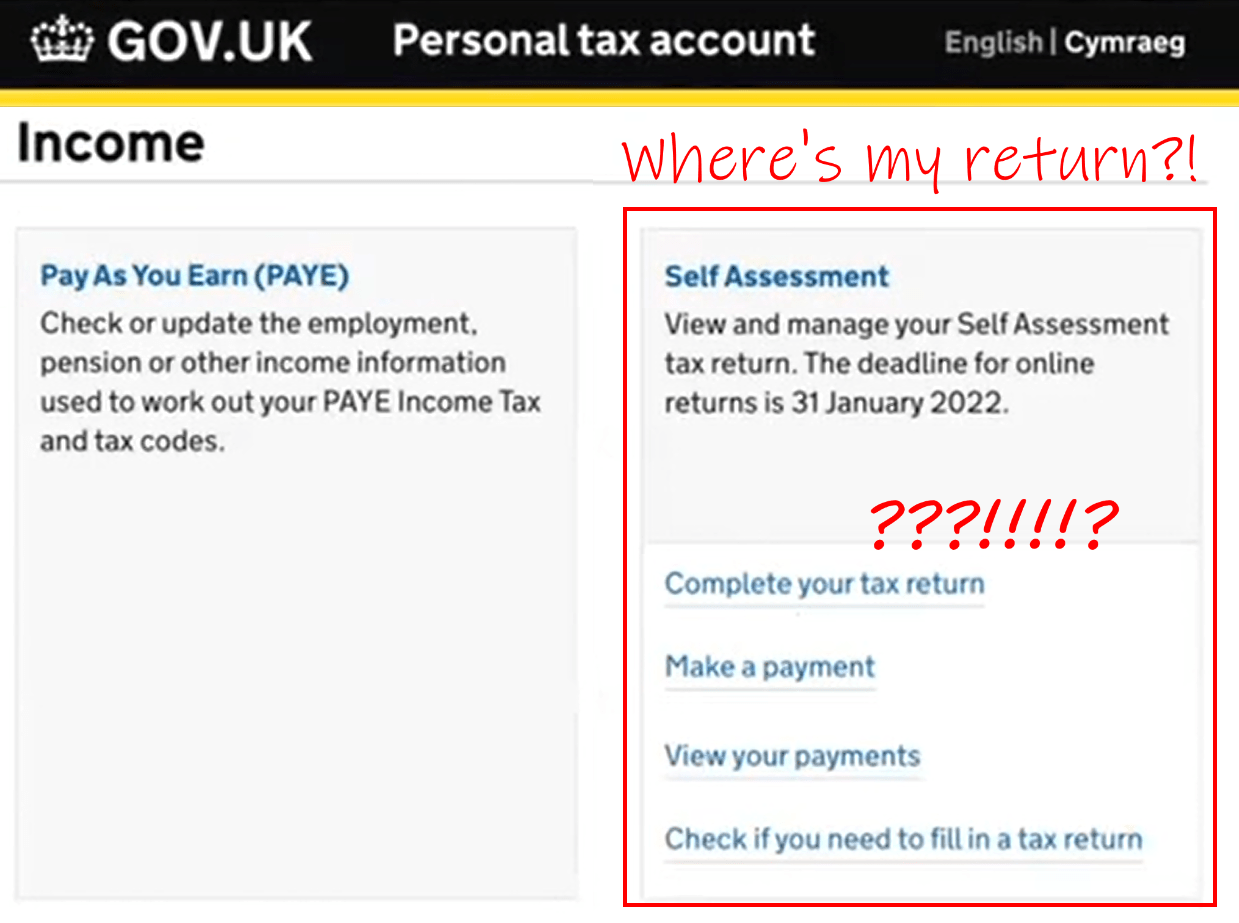

A reminder that HMRC effectively extended the 2019/20 tax filing deadline by a month to Sunday 28 February. That date is almost upon us, so if you haven’t yet submitted your return online, make sure you do so now to escape a fine.

Official figures revealed that almost two million people missed the original 31 January deadline this year – nearly twice the amount that we saw this time last year, most likely due to the additional pressures that COVID-19 has caused, including home schooling.

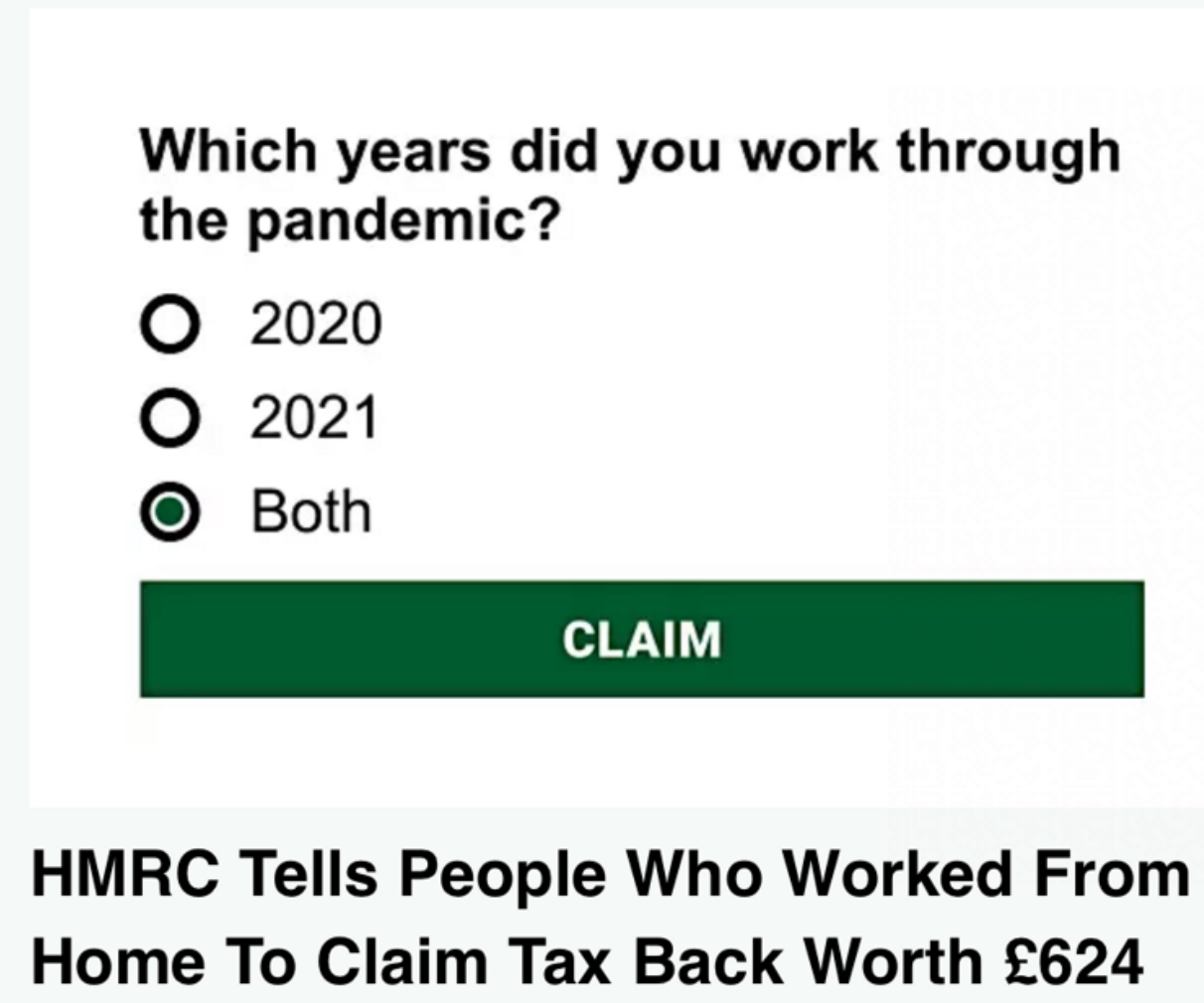

Earlier this month we also heard that HMRC is also waiving the 5% late payment penalty as long as you pay your tax bill for this period by 1 April 2021, even though you will still be charged a small amount of interest (at 2.6%).

It’s been an exceptionally challenging 12 months and hopefully these filing and payment extensions have given individuals a bit of breathing space to get their tax payment affairs in order.

If you’re struggling to pay what you owe then please get in touch with HMRC who have said they’re willing to consider setting up ‘time to pay’ arrangements to spread the payment of self-assessment tax bills until January 2022. You will still need to make sure your tax returns are up to date before HMRC will discuss this with you.

If you’re an untied user and need any support, we’re here to help.

What if I can’t afford to pay my tax bill?

As soon as you’ve submitted your return, we suggest you contact HMRC to arrange a payment plan. It’s in your interests and theirs for you to be able to pay things back at a level you can afford.

If you need to negotiate a payment plan with HMRC, make sure you have in mind what you can afford.

untied’s help pages have more information on making arrangements to pay your tax here.