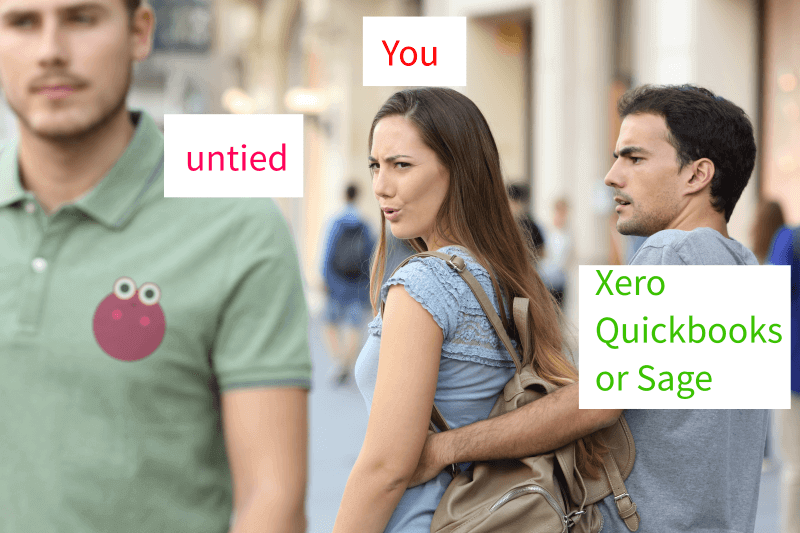

untied - an alternative to Xero, QuickBooks, Sage, FreeAgent or Kashflow

Are you looking for the best solution to be able to track your income and expenses, and get your taxes sorted as quickly and as simply as possible? Perhaps a quicker, cheaper, and easier option than other software you see?

In this quick guide, we’ll discuss some alternatives and help you choose the right software for you.

The guide will help you whether you're making the switch from Excel (or even paper), or if you're using cloud accounting software and want something that's more relevant to your personal needs than Xero, QuickBooks, Sage, FreeAgent, or Kashflow.

You might be surprised to find that we don’t always recommend untied.

TL;DR? - skip to the recommendation summary

What software should I use for my business?

You’ll have seen (and heard) adverts for large software companies such as Xero, Sage, and QuickBooks.

They’re great software products. And we mean it.

Xero is great if you’re a growing company. QuickBooks is great for VAT returns. And Sage has tools to manage your cash flow and scan invoices and receipts. FreeAgent is a good product for your company that comes with some NatWest, Mettle, RBS, and Ulster Bank accounts. And when Kashflow came out it was really breaking ground, and it's now owned by IRIS which is a big and highly respected company providing software to accountants.

We hold them in high regard. untied prepares our own accounts with Xero, and we've also used QuickBooks and Sage, and other software which has been bought by IRIS.

There’s a theme – all of these products are designed for companies first and foremost — but what if you’re not a limited company?

Well, that's why we are here. We saw that all this software was being built for small companies, but we wanted to create the best product for people who need to do a tax return. Whether self-employed as freelancers, other types of sole trader, earning on platforms such as Etsy, Fiverr, Deliveroo, Uber, Depop, and Vinted, renting out property on Airbnb or as landlords, or as higher earners. Whether you call it accounting, bookkeeping, tax, or just untied, it's a product built for people, not companies.

If you’re a person, you’ll need something designed around you. A product that’s straightforward to use. Something that takes care of everything you need for your personal taxes from gathering data, filing, and payment, and which links to how you earn.

You want untied.

Three reasons why untied is right for you as an individual

- untied is built specifically for self-assessment tax returns, not for company tax returns

Most people don’t need the details of double-entry bookkeeping, accruals, or accounting periods.

Instead untied helps you earn and do the filings that are essential to you, in ways that you understand. No need for separate bank accounts - untied makes it easy if you sometimes (or always) use your personal account for business transactions (even if your bank may not like it).

- While of course untied supports your income as someone who is self-employed, a property landlord, or a higher earner, there’s more than one dimension to how you earn. untied supports your other income sources. A salary. Dividends. Interest.

A summary of our recommendations when choosing the right software

We recommend Xero if:

- You’re a limited company, or are VAT registered and have some experience in accounting

- You have employees and need to run payroll.

We recommend QuickBooks if:

- You’re a limited company and want the simplest onboarding.

We recommend Sage if:

- You’re a limited company and find Xero and QuickBooks confusing. Sage takes a different approach and we find that their SageOne/ Sage Business Cloud accounting product is easy to use

- It’s also good for payroll.

We recommend FreeAgent if:

- You’re a limited company and have a NatWest, RBS, Ulster Bank, or Mettle account that includes it for free.

We recommend Kasfhlow if:

- You’re a limited company and your accountant recommends it as the best way for them to help you.

We recommend untied if:

- You’re an individual who needs to take care of your self-assessment tax return - this could be because you’re self-employed, renting out property, a higher earner, a non-resident, or for other reasons

- You want something that’s really quick and easy to use

- You’re looking for five-star customer service