Have you got your P60 or P11D?

What is a P60 and how do I get one?

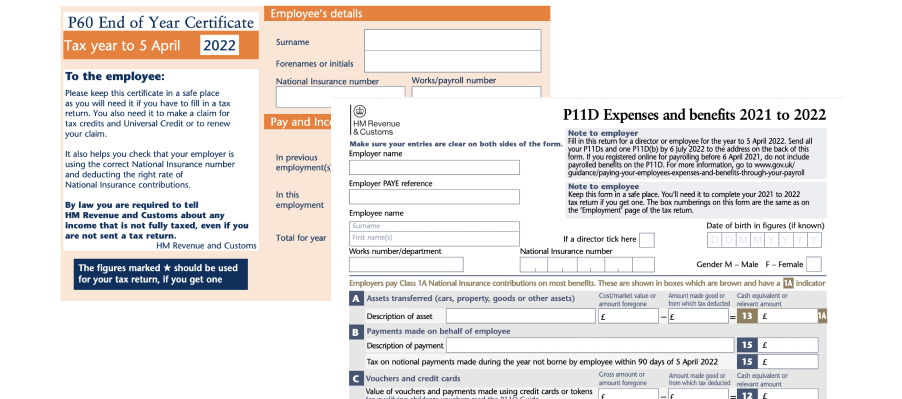

A P60 (also known as an ‘end of year certificate’) is a handy annual statement issued to employees by their employer. It shows the amount of tax and national insurance (NI) contributions paid over the previous tax year through the PAYE system. A P60 can be issued in either an electronic or paper format.

If you’re employed by an employer in any capacity, it’s a legal requirement that you receive it by 31 May after the end of the tax year. Look out for it as it’s an important part of your tax return.

If you have both an ‘employed’ job and some self-employment (ie through a second job, side hustle or rental property) it’s critical that you know, and can prove, how much money you’ve made and how much tax you’ve paid via your PAYE employment so you can enter this into your tax return. Your P60 is the simplest and best way to do exactly that.

Why do I need a P60?

P60s are issued by employers to employees for their own personal records. The employee may need this information as proof of income or to prove how much tax they’ve paid, for example, to apply for a mortgage or loan, to apply for tax credits, to claim back any overpaid tax or to complete any self-assessment return for other taxable income.

When filing a self-assessment return, the law requires employees to keep a record of their taxable income, including their P60, for at least 22 months after the end of the tax year to which the return relates.

What’s on a P60?

- Employee name

- National insurance number

- Pay and income tax details

- Tax code

- National insurance contributions from current employment

- Statutory pay (ie sick, maternity, paternity, adoption etc)

- Student / postgrad loan deductions

Do I get a P60 if I'm self-employed?

P60s are issued by an employer, so you won't receive one if you’re self-employed.

Benefits in kind (P11D)

Whilst we’re at it, another form your employer might give you is your P11D. This is used to report ‘benefits in kind’ – ie items or services which you receive from your company in addition to your salary, such as private healthcare, interest-free loans (to pay for train season tickets, for example) and company cars. The annual P11D form allows you to report these items to HMRC on your annual self-assessment return.

If these kinds of expenses apply to you, your employer will supply a copy of the P11D form for you to check over and keep – and you should receive this by 6 July following the end of the tax year. If you don't receive any taxable expenses or benefits then you might not receive the form at all.

Going forward, expenses will be on payroll so you may not get a P11D.

I left a job and got a P45

Employees who have left a business during the tax year won’t get a P60 as all the necessary information will be on their P45 (the document that you get when you leave a job which outlines how much taxable salary someone has paid over the course of the current tax year, along with how much has been deducted, and the tax code at the time of leaving the job).